Banks expecting Kenyans to default more on loans

Banks have expressed fears that Kenyans could default more on loans in the near future, the Central Bank od Kenya (CBK) has revealed.

According to CBK's Credit Officer Survey, credit risk is the largest factor affecting the soundness of financial institutions and the financial system.

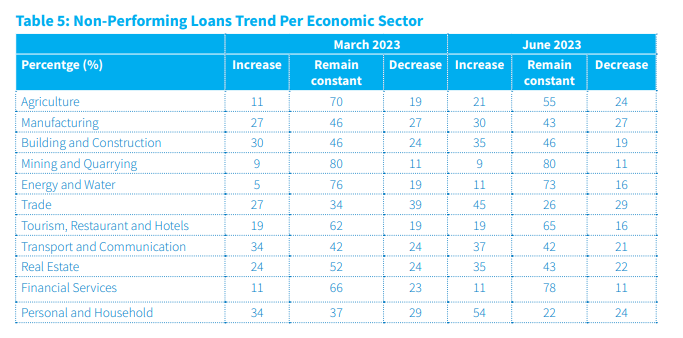

The banks surveyed by CBK indicated that the level of non-performing loans (NPLs) is expected to remain constant in nine economic sectors and increase in personal and household, and trade sectors during the next quarter.

42 per cent of the lenders indicated that NPLs are likely to rise in the third quarter of 2023 while 34 per cent of the respondents expect the level of NPLs to fall. 24 per cent of the banks expect the level of NPLs to remain constant in the third quarter of 2023.

I a bid to avoid more losses from NPLs, for the quarter ending September 30, 2023, banks expect to intensify their credit recovery efforts in eight economic sectors and retain them in three sectors (mining and quarrying, energy and water, and finance).

"Credit risk is the single largest factor affecting the soundness of financial institutions and the financial system. This is because lending is the principal business for banks. The ratio of gross loans to total assets increased marginally from 56.9 percent in the quarter ended March 31, 2023, to 56.4 percent in the quarter ended June 30, 2023," the report read in part.

Banks' performance in Q2

During the period under review, gross loans increased by 3.3 per cent from Ksh3.9 trillion in March 2023, to Ksh4 trillion in June 2023.

"The increase in gross loans was largely witnessed in the trade, transport and communication, personal and household, and manufacturing sectors. The increase in gross loans was mainly due to increased loans granted to individual borrowers," the report added.

Total deposits increased by 6.9 percent from Ksh 4.8 trillion in March 2023, to Ksh5.2 trillion in June 2023.

The asset quality, measured by gross nonperforming loans to g ross loans ratio deteriorated from 14.0 per cent in March 2023, to 14.5 per cent in June 2023. This was due to a 6.5 per cent increase in gross NPLs compared to a 3.3 per cent increase in gross loans.

The capital adequacy ratio increased from 18.4 per cent in March 2023 to 18.6 per cent in June 2023.

Quarterly profit before tax increased by Ksh25.9 billion from Ksh65.1 billion in March 2023, to Ksh91.0 billion in June 2023. The increase in profitability was mainly attributable to a higher increase in quarterly income by Ksh117.4 billion compared to the increase in quarterly expenses by Ksh91.5 billion.

Return on Equity (ROE) increased from 27 per cent in March 2023, to 33 per cent in June 2023. The increase in ROE was due to increased quarterly profit before tax.

Liquidity in the banking sector decreased marginally from 49.9 percent in March 2023, to 49.7 percent in June 2023. This was well above the minimum statutory ratio of 20 per cent.

The aggregate balance sheet increased by 4.2 per cent to Ksh.7,052.4 billion in June 2023, from Ksh6.8 trillion in March 2023.